The Hamilton County Ohio Property Tax Calculator (2026) is an informational tool that helps homeowners, buyers, sellers, and investors estimate property taxes across Hamilton County. There is no single countywide tax rate, as taxes vary by tax district and voter-approved levies. For 2026, the average effective property tax rate is about 1.44%, with higher rates in areas like Terrace Park (≈2.55%) and Cincinnati (≈2.03%), based on assessed property value.

Hamilton County Ohio Property Tax Estimator For 2026

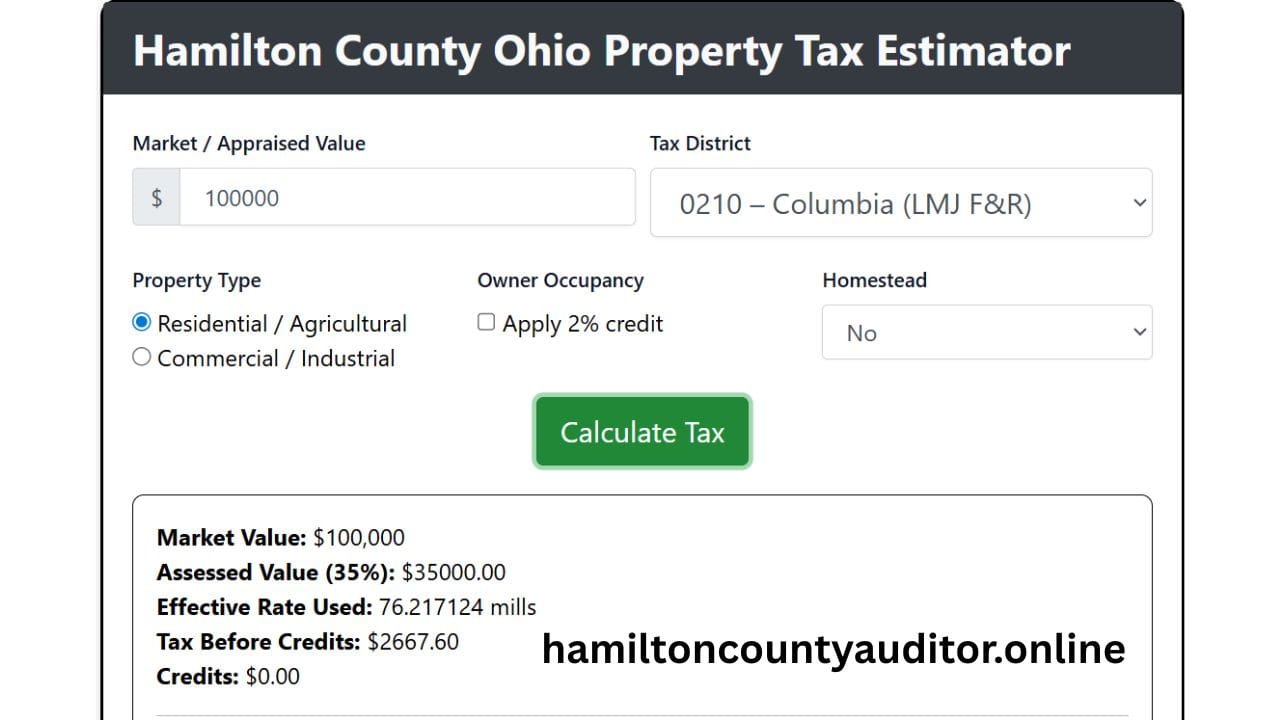

How the Hamilton County Property Tax Calculator Works

The Hamilton County Property Tax Calculator estimates annual property taxes by applying certified district-specific rates to assessed property values. Users select market value, tax district, and property type for accurate tax estimates

Step 1: Enter Market (Appraised) Value

The market value is the estimated value of the property.

Example:

- Market Value: $250,000

Step 2: Assessed Value Calculation

Ohio law requires property to be assessed at 35% of market value.

Example Calculation:

- $250,000 × 35% = $87,500 Assessed Value

Step 3: Select the Correct Tax District

Choose the tax district where the property is located. Each district has its own certified effective tax rate.

Step 4: Choose Property Type

- Residential / Agricultural – Uses residential effective tax rates

- Commercial / Industrial – Uses commercial effective tax rates

Step 5: Estimated Tax Calculation

The calculator applies the selected district’s effective tax rate to the assessed value to estimate annual property tax.

Step 6: Optional Credits

The tool may show estimated credits such as:

- Owner-occupancy credit (example)

- Homestead or disabled veteran credit (example)

These are estimates only and may vary on official tax bills.

Benefits of Using This Property Tax Calculator

The Hamilton County Property Tax Calculator helps homeowners, buyers, and investors understand potential taxes, compare districts, plan budgets, and make informed property decisions using certified effective rates for accurate estimates.

For Homeowners

- Understand potential yearly tax responsibility

- Plan household budgets more accurately

For Home Buyers

- Compare tax costs between neighborhoods

- Avoid unexpected tax surprises after purchase

For Real Estate Investors

- Analyze property cash flow

- Compare districts before investing

General Benefits

- Easy to use

- Mobile-friendly

- Based on certified public tax rate data

- Improves transparency

Hamilton County Ohio Property Tax Rate

The table below shows examples of Hamilton County tax districts and how their effective tax rates are used in the calculator.

| Tax District Code | Tax District Name | Residential Effective Rate (mills) | Commercial Effective Rate (mills) | How the Rate Is Used |

|---|---|---|---|---|

| 1110 | Cincinnati City | 69.1386 | 82.2852 | Applied when Cincinnati is selected |

| 0020 | Anderson Township | 70.6866 | 90.3259 | Used for Anderson Township properties |

| 0210 | Columbia Township (LMJ F&R) | 76.2171 | 95.6534 | Fire & township services included |

| 0230 | Silverton Fire District | 70.6180 | 88.6968 | Fire district rate applied |

| 0220 | Ridge Fire District | 73.1543 | 91.2248 | Fire services impact tax |

| 0340 | Delhi Township | 75.1134 | 96.0420 | Township + school taxes |

| 0430 | Green Township | 66.9554 | 83.9645 | Lower township rate |

| 0850 | Springfield Township | 76.0000 | 94.7210 | Higher service coverage |

| 0625 | Norwood City | 60.4906 | 76.0467 | City-based tax district |

| 0550 | Madeira City | 63.0386 | 76.1852 | Smaller city tax base |

| 0495 | Indian Hill Village | 56.4986 | 69.6452 | One of the lowest rates |

| 0280 | Golf Manor Village | 79.8131 | 97.1945 | Higher municipal services |

| 0070 | Cheviot City | 69.5619 | 84.8496 | City + school combination |

| 0557 | Mariemont Village | 62.2219 | 76.4720 | Village district |

| 1100 | Wyoming City | 65.5386 | 78.6852 | City district rates |

| 0275 | Milford (Indian Hill SD) | 53.6101 | 69.0000 | Mixed district coverage |

How Tax Rates Are Applied in the Tool

The calculator applies district-specific certified effective tax rates based on the selected property type. Residential or commercial rates are multiplied by assessed value to provide accurate estimated annual property taxes.

Residential Properties

When a user selects Residential / Agricultural, the calculator automatically applies the residential effective rate for the chosen tax district.

Commercial Properties

When Commercial / Industrial is selected, the calculator applies the commercial effective rate, which is generally higher due to Ohio tax law.

Why Effective Tax Rates Are Used

Effective tax rates reflect the real tax burden after Ohio’s reduction factors. Using them ensures property tax estimates are accurate, comparable across districts, and represent the actual amount homeowners and investors may owe.

Understanding Effective Rates

Effective tax rates reflect the actual tax burden after Ohio reduction factors are applied. They provide a more realistic estimate than raw voted millage.

Accuracy for Users

Using effective rates helps users:

- Avoid overestimation

- Compare districts fairly

- Understand real-world tax impact

What Is a Tax District in Hamilton County

A tax district in Hamilton County combines county, city or township, school, library, and special district taxes. Each district has a unique effective rate, affecting property tax amounts for residents and investors.

Understanding Tax Districts

Hamilton County is divided into multiple tax districts. Each tax district represents a combination of:

- County taxes

- City or township taxes

- School district taxes

- Library, vocational, and special district taxes

Because every area has a different combination of these taxes, property tax rates vary by location. Selecting the correct tax district is essential for an accurate estimate.

Why Tax Districts Matter

- Two properties with the same value can have different taxes

- School district and city services greatly affect tax rates

- Investors use districts to compare long-term costs

Conclusion

The Hamilton County Ohio Property Tax Calculator simplifies complex tax information into an easy-to-understand estimate. By selecting a tax district and property type, users can quickly see how property taxes may vary across Hamilton County. This tool is especially useful for planning, comparison, and financial awareness.

FAQs

1. What is the Hamilton County Ohio Property Tax Calculator?

The calculator estimates annual property taxes based on market value, assessed value (35% of market), tax district, and property type. It helps homeowners, buyers, and investors plan their finances.

2. How are property taxes calculated in Hamilton County Ohio?

Taxes are calculated by multiplying the assessed value (35% of market value) with the district-specific effective tax rate. Credits like owner-occupancy or homestead may reduce the final amount.

3. What is a tax district in Hamilton County?

A tax district combines county, city/township, school, library, and special district taxes. Each district has unique effective rates affecting the property tax bill.

4. What is the difference between residential and commercial property taxes?

Residential properties use residential effective rates, while commercial/industrial properties use commercial rates, which are usually higher due to Ohio tax regulations.

5. Are the estimates from the calculator exact?

No. The estimates are informational only. Actual taxes may vary based on reassessments, exemptions, and official levies by the Hamilton County Auditor.

6. How can I find my tax district?

Tax districts can be found on the Hamilton County Auditor website, property deed records, or by contacting the local township or city office.

7. Can I apply for credits like Homestead or Owner-Occupancy in the calculator?

Yes. The calculator allows users to apply placeholder credits for planning purposes, but the official tax credits are determined by the Auditor’s Office.

8. Why use effective tax rates instead of raw millage?

Effective rates reflect Ohio’s reduction factors, providing a realistic estimate of the actual tax burden rather than just the voted millage.

9. Who benefits from using this property tax calculator?

Homeowners – plan budgets accurately

Buyers – compare properties across districts

Investors – analyze cash flow and property tax impact.

10. Where can I get official Hamilton County property tax information?

For accurate, official data, consult the Hamilton County Auditor’s Office or visit their official website for certified rates and tax records.