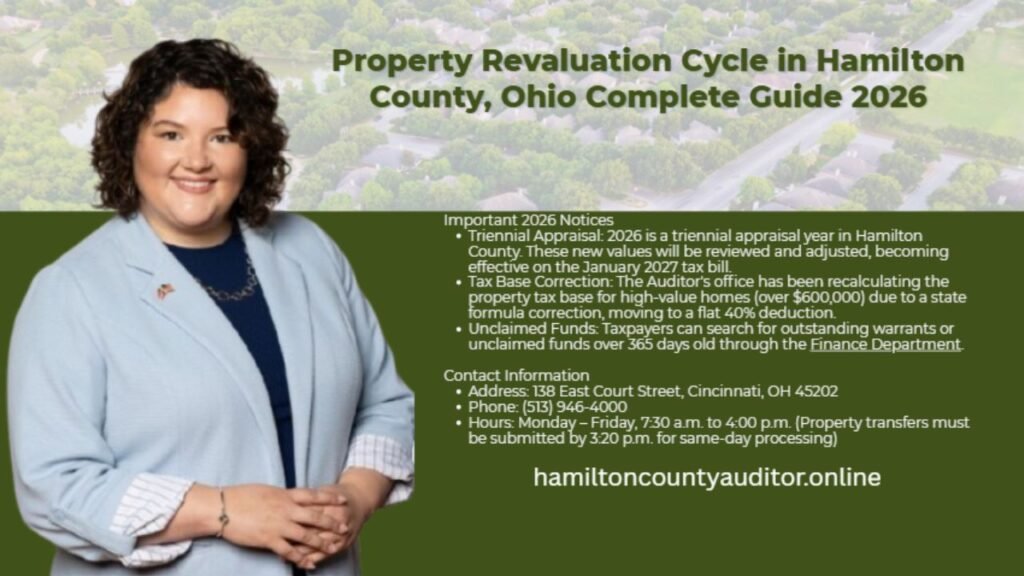

Property Revaluation Cycle in Hamilton County, Ohio Complete Guide 2026

The Property Revaluation Cycle in Hamilton County, Ohio for 2026 marks a Triennial Update based on recent market sales, not a full property inspection like the 2023 Sexennial Reappraisal. Values reflect conditions as of January 1, 2026, with auditor adjustments finalized mid-to-late 2026 and shown on January2027 tax bills. Property owners should monitor CAUV deadlines, review Homestead eligibility, and file Board of Revision appeals between January 1 and March 31 if needed.

Definition and Purpose

Property revaluation (or reappraisal) is the process through which Hamilton County updates the official value of all real estate properties. The goal is to ensure that all properties are assessed fairly based on current market values.

Ohio law requires all counties to review property values regularly, including a full reappraisal every six years and triennial updates in between.

How Property Values Are Determined

The Hamilton County Auditor considers multiple factors when determining property values:

- Location and neighborhood trends

- Property type (residential, commercial, industrial)

- Size, age, and condition of the property

- Recent sales of comparable properties

This ensures that your property value reflects the true market conditions, not outdated assessments.

Property Revaluation Cycle Timeline

Full Reappraisal vs. Triennial Update

Hamilton County follows a structured cycle:

| Year | Type of Revaluation | Description |

|---|---|---|

| 2023 | Full Reappraisal | Comprehensive update, including physical inspections of properties |

| 2026 | Triennial Update | Simplified review based on recent market sales |

| 2029 | Full Reappraisal | Next full assessment cycle begins |

Why the Cycle Matters

Understanding the cycle is crucial because tax bills may change when property values are updated. Accurate valuations ensure fair taxes, but sudden increases in market values can affect your property tax.

Why People Search About Property Revaluation

Property revaluation is a hot topic for Hamilton County homeowners. Common reasons people search for it include:

- Receiving a revaluation notice in the mail

- Concerns about increased property taxes

- Wanting to appeal or contest a valuation

- Checking property values before buying or selling

The revaluation process affects financial planning, making it essential for homeowners to stay informed.

Forms and How to File an Appeal

Board of Revision Forms

If you believe your property has been overvalued, you can file a complaint with the Hamilton County Board of Revision (BOR). Required forms include:

| Form | Purpose | Notes |

|---|---|---|

| DTE Form 1 | Regular residential property complaints | Submit by March 31 for the assessment year |

| DTE Form 1M | Manufactured homes | Follow the same deadlines |

Step-by-Step Appeal Process

- Check your property value on the Hamilton County Auditor website

- Gather evidence (comparable sales, appraisals, property condition photos)

- Complete the appropriate form (DTE Form 1 or 1M)

- Submit the appeal online, by mail, or in person

- Attend a BOR hearing if required

- Receive final decision – approved, reduced, or denied

Filing on time is critical; late appeals are usually not accepted.

Hamilton County Auditor & Board of Revision Office Details

| Office | Contact Information | Office Hours |

|---|---|---|

| Hamilton County Auditor | Phone: (513) 946‑4000 Website: hamiltoncountyauditor.org | Mon–Fri: 7:30 AM – 4:00 PM |

| Board of Revision | Phone: (513) 946‑4035 Email: bor@hamiltoncountyauditor.org | Mon–Fri: 7:30 AM – 4:00 PM |

These offices can assist with:

- Property valuation questions

- Appeals and form submissions

- Guidance on timelines and documentation

Benefits of Property Revaluation

Property revaluation is not just a bureaucratic process it has several key benefits:

- Fairness: Ensures all properties are assessed at true market value.

- Accuracy: Corrects outdated assessments that may have been in place for years.

- Transparency: Homeowners receive notices and can appeal if they feel valuations are too high.

Accurate assessments help maintain equity in taxation and support local services funded by property taxes.

Potential Issues / Drawbacks

While revaluation ensures fairness, there are possible downsides:

- Tax increase risk: If property values have risen in the market, your tax bill may increase.

- Appeal challenges: The appeal process can be time-consuming and requires evidence.

- Temporary confusion: Homeowners may misinterpret notice letters or deadlines.

Being informed and proactive can minimize negative impacts.

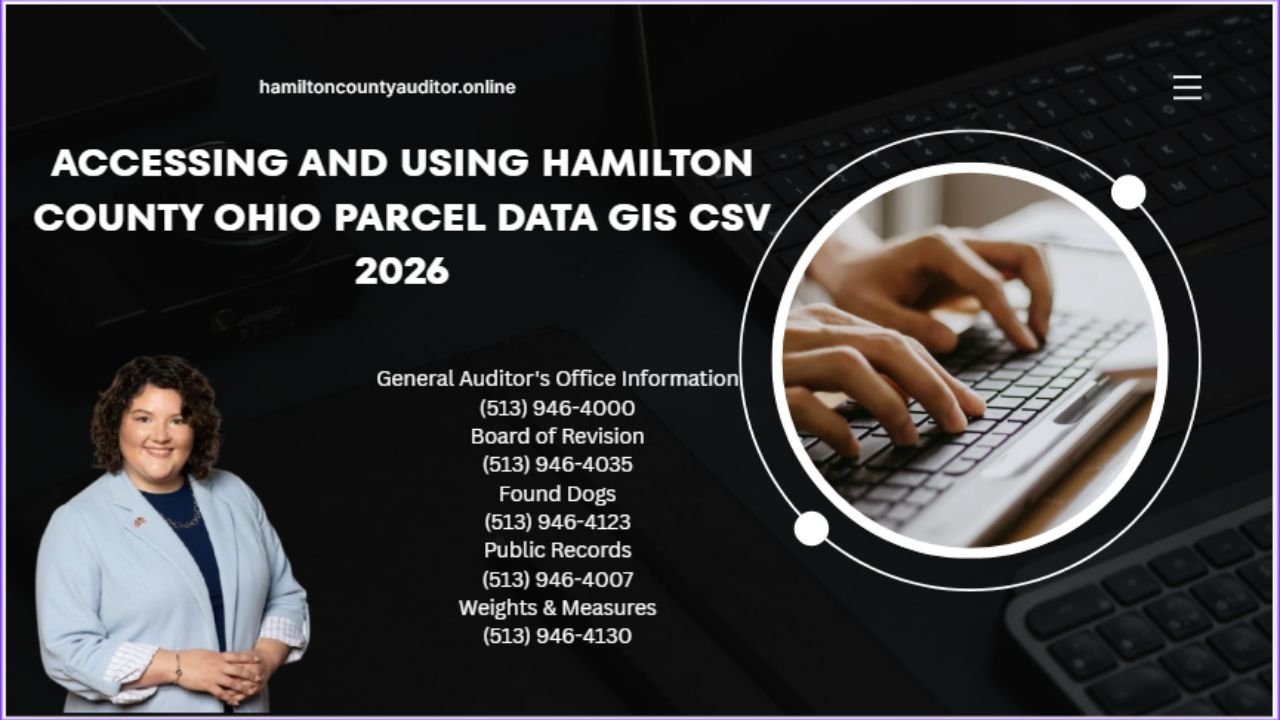

How to Check Your Property Value Online

Step-by-Step Guide

- Visit the Hamilton County Auditor Property Search

- Enter your parcel number, address, or owner name

- Review your current assessed value, recent sales, and property details

- Compare with similar properties to assess fairness

This online tool is free and updated regularly, allowing you to monitor changes before your tax bill arrives.

Conclusion

The property revaluation cycle in Hamilton County, Ohio ensures that property assessments are accurate, fair, and market-based. Understanding the process, timelines, forms, and appeal options helps homeowners avoid surprises and make informed decisions. Always review your revaluation notice carefully and use the BOR appeal process if you believe your assessment is too high.

FAQs

What is property revaluation in Hamilton County?

It is the official process to update property values based on current market conditions.

How often does Hamilton County revalue properties?

Full reappraisal every 6 years, with triennial updates in between.

Will my property taxes increase after revaluation?

Not automatically, but higher assessed values can affect taxes if levies remain the same.

How do I check my property’s new value?

Use the Hamilton County Auditor’s online property search tool.

Can I appeal my property valuation?

Yes, through the Board of Revision using DTE Form 1 or 1M.

Which forms are required for an appeal?

DTE Form 1 for regular properties, DTE Form 1M for manufactured homes.

What is the deadline to file an appeal?

Typically by March 31 of the assessment year.

What are the office hours of the Auditor and BOR?

Monday–Friday, 7:30 AM – 4:00 PM.

Who decides property values in Hamilton County?

The Hamilton County Auditor and Board of Revision oversee and finalize assessments.

What are the benefits and risks of revaluation?

Benefits: fairness, accuracy, transparency. Risks: possible higher taxes and time-consuming appeals.

Post Comment