Hamilton County Ohio Property Appraiser

How Hamilton County, Ohio, calculates property taxes through the Auditor’s “Just Value” system in 2026 Using sales comparisons, cost, and income approaches, properties are fairly assessed at 35% of market value.The appraisal methods, periodic revaluation cycles, and key details behind residential and commercial property valuations. How your property’s assessed value impacts your tax bill and stay informed about fair, transparent property taxation in Hamilton County.

Hamilton County Property Reappraisal Cycle/Process

In Hamilton County, the Auditor updates property values on a predictable schedule to reflect changing market conditions. A full reappraisal was completed in 2023, followed by a triennial update in 2026, with the next full reappraisal planned for 2029. This 2023 → 2026 → 2029 cycle helps property owners anticipate when countywide value changes may affect tax assessments and plan their finances accordingly.

1. Key Concepts

The appraisal process begins with defining essential terms. Homeowners should understand how market value and assessed value influence taxes, ensuring clarity about how the county determines their property’s worth.

Market Value (Appraised Value)

Market value is the estimated price a property would sell for on the open market, as determined by the Auditor. For example, if a home sells for $300,000, that represents its current fair market value for assessment purposes.

Assessed Value

Ohio law sets the assessed value at 35% of market value. Using the previous example, a $300,000 home would have an assessed value of $105,000. This figure is the basis for property tax calculations.

Purpose of Appraisal

The main goal is fair tax distribution. By assessing property based on its value, Hamilton County ensures homeowners contribute proportionally, preventing overpayment while keeping taxes aligned with market trends.

2. Appraisal Methods

Hamilton County uses three approaches to estimate property value accurately. Each method considers different property characteristics, whether for residential or commercial real estate.

Sales Comparison Approach

This method compares your property to similar homes recently sold nearby. For instance, if a 3-bedroom house sold for $250,000, a similar property will be valued around that amount, adjusting for size or features.

Cost Approach

The cost approach calculates the expense to rebuild a property, minus depreciation, plus land value. Example: Replacing a house costs $200,000, minus $20,000 depreciation, plus $50,000 land value, totaling $230,000 appraisal value.

Income Approach

Used mainly for commercial properties, this approach considers potential rental or business income. A small retail shop generating $24,000 yearly might be appraised at $240,000, based on income capitalization rates.

3. The Reappraisal Cycle

Revaluations in Hamilton County occur periodically to reflect current market trends. This ensures that property assessments remain fair, accurate, and up-to-date for taxation purposes.

Frequency of Reappraisal

Ohio law mandates a full property reappraisal every six years, with a triennial update. Annual market reviews ensure significant shifts in property values are accounted for, keeping tax bills reasonable.

Data Sources Used

Appraisers rely on sales data from comparable properties, recent construction costs, and rental incomes to determine accurate values. This ensures residential and commercial properties reflect realistic market conditions.

4. Important Details

Property owners should understand how appraisals affect taxes and how to verify their assessed value. Knowledge of these details prevents surprises during tax season.

Tax Bill Calculation

Property tax bills are based on assessed value multiplied by local tax rates. For example, a $105,000 assessed home with a 2% tax rate results in $2,100 annual property taxes. Accurate assessments keep this fair.

Understanding Adjustments

While market values are checked yearly, major adjustments align with legal reappraisal cycles. This prevents sudden spikes and allows homeowners to anticipate changes in tax obligations based on property value trends.

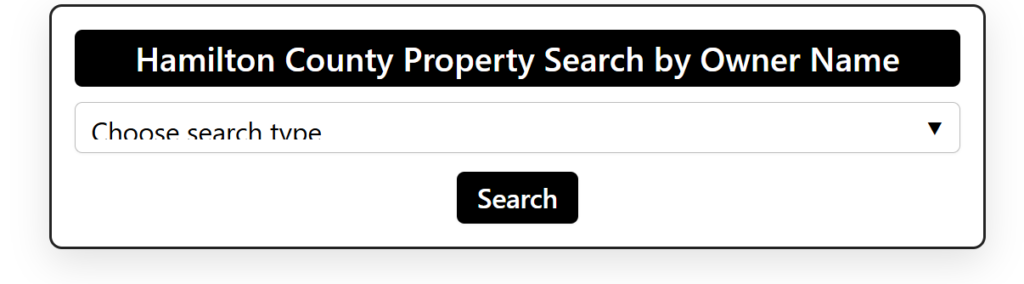

How to Search Property Records in Hamilton County Ohio

You can access most property information online using the county’s official search tools.

You may search by:

Hamilton County Property Appraiser Forms & Applications

Several commonly used forms are available through the Auditor’s Office:

Homestead Exemption

Designed for eligible seniors, disabled homeowners, or surviving spouses. This program can significantly reduce taxable value on a primary residence.

Owner Occupancy Credit

Provides tax savings when you live in the property as your primary home.

Valuation Appeal (Board of Revision)

If you believe your property value is too high, you may file an appeal with supporting evidence such as comparable sales or appraisal reports.

Conveyance & Transfer Forms

Required when property ownership changes.

In Hamilton County, Ohio, transferring property ownership requires recording a new deed along with a specific Hamilton County Conveyance Form, which details buyer/seller info, property description, and conveyance codes. A mandatory transfer fee of $3 per $1,000 of the sale price, plus $0.50 per parcel, applies.

Common Mistakes Property Owners Make

- Ignoring valuation notices

- Missing appeal deadlines

- Forgetting to apply for exemptions

- Assuming assessments are always correct

Staying proactive protects your financial interests.

Conclusion

The Hamilton County Ohio Property Appraiser, operated by the County Auditor, ensures accurate property valuations and fair taxation across the region. Whether you’re checking home values, estimating taxes, filing appeals, or applying for exemptions, understanding this system helps protect your investment. By staying informed, using online tools, and reviewing assessments regularly, homeowners and buyers can confidently navigate Hamilton County’s real estate process while maximizing available tax-saving opportunities

FAQs

1. What is the Hamilton County Ohio Property Appraiser?

The Hamilton County Property Appraiser is handled by the County Auditor, who determines property values, maintains parcel records, and supports fair property taxation.

2. How can I look up property records in Hamilton County Ohio?

You can search properties online using the county auditor’s website by entering an owner name, property address, or parcel number.

3. How is assessed value calculated in Hamilton County?

Ohio uses approximately 35% of the property’s market value as the assessed value, which is then multiplied by local tax rates.

4. Can I appeal my property value in Hamilton County?

Yes. Homeowners may file a Board of Revision complaint if they believe their property valuation is inaccurate.

5. What exemptions are available for homeowners?

Eligible residents may apply for Homestead Exemption and Owner Occupancy Credit to reduce taxable value.

6. How often does Hamilton County reassess property values?

Hamilton County performs a full reappraisal every six years with a triennial market update every three years.

7. Does higher property value always mean higher taxes?

Not always. Tax bills depend on assessed value and millage rates, which may change annually.

8. Are Hamilton County property records free to access?

Yes, most property search tools are available online at no cost, though certified copies may have small fees.

Post Comment