Hamilton County Ohio Property Reassessment Appeal Process Complete Guide

Property taxes in Hamilton County, Ohio are based on the assessed value of real estate. When a reassessment increases a property’s value, it can directly raise the annual tax bill. If a homeowner believes the new value is inaccurate or unfair, Ohio law allows them to challenge it through a formal appeal process. This guide explains the Hamilton County property reassessment appeal process in clear, practical terms so property owners understand their rights, responsibilities, and options.

Understanding Property Reassessment in Hamilton County

A property reassessment is the county’s review of a property’s market value to ensure assessments reflect current real estate conditions. The Hamilton County Auditor conducts periodic updates using recent sales data, property characteristics, and market trends.

Reassessment does not automatically mean higher taxes, but when values rise, tax obligations often increase. This is why reassessment notices are closely reviewed by homeowners, investors, and commercial property owners.

Understanding Your Property Assessment Notice

When reassessment occurs, the Auditor mails a property assessment notice to the owner of record.

What the notice includes:

- Parcel number

- Owner name and property address

- Current market value

- Previous market value

- Instructions on how to appeal

It is important to compare the listed value with recent sales in your neighborhood and your property’s actual condition.

Hamilton County Property Reassessment Appeal Process (Step by Step)

Step 1: Review and Verify Your Property Value

Before filing an appeal, review your property record on the Auditor’s website and compare it with:

- Recent comparable sales

- Your purchase price (if recently bought)

- The condition and features of your property

If the value appears inaccurate, you may proceed with an appeal.

Step 2: File a Complaint With the Board of Revision

Property owners must file a formal complaint during the designated filing period.

Standard Filing Period:

- January 1 through March 31 (postmarked by March 31)

Appeals are filed using state-approved forms.

Required Forms for Property Appeal

| Form Name | Purpose | Who Uses It |

|---|---|---|

| DTE Form 1 | Real property valuation complaint | Residential & commercial owners |

| DTE Form 1M | Manufactured or mobile homes | Mobile home owners |

Forms may be submitted by mail or in person. Email submissions are not accepted.

Supporting Documents and Evidence

Strong evidence increases the chances of a successful appeal. Common supporting documents include:

- Recent comparable sales (within the last 12–24 months)

- Independent appraisal reports

- Photos showing property condition or damage

- Contractor repair estimates

- Closing statement if recently purchased

- Proof of incorrect county records

Evidence should clearly explain why the current value does not reflect fair market value.

Board of Revision Hearing Process

After filing, the BOR schedules a hearing.

What to Expect at the Hearing:

- Hearings are brief and formal

- Property owners may represent themselves

- Attorneys or licensed appraisers are optional, not required

- Evidence must support the requested value change

Owners should be prepared to explain their position clearly and factually.

Decision Timeline and Notification

After the hearing, the Board of Revision reviews the evidence and issues a written decision.

- Decisions are typically mailed within several weeks

- The notice will confirm the new value or explain why no change was made

- Approved reductions are reflected in future tax bills

Options If You Disagree With the BOR Decision

If the BOR decision is unfavorable, further appeals are available.

Additional Appeal Options:

- Ohio Board of Tax Appeals (BTA)

- Court of Common Pleas

These appeals must generally be filed within 30 days of the BOR decision and may involve legal representation.

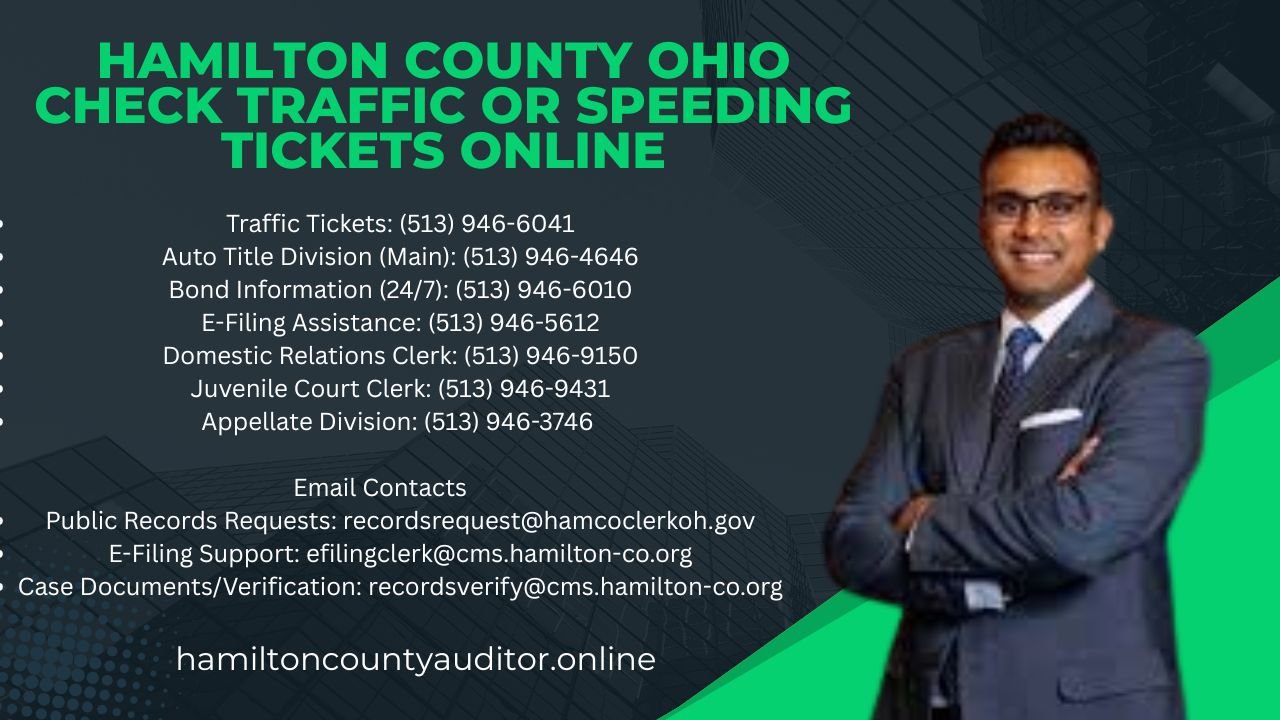

Hamilton County Auditor & Board of Revision Office Information

| Office | Details |

| Address | 138 E. Court Street, Room 304, Cincinnati, OH 45202 |

| Phone | (513) 946-4035 |

| Office Hours | Monday–Friday, approximately 7:30 AM to 4:00 PM |

Visiting in person is helpful if you need assistance with forms or clarification before filing.

Office Contact Information

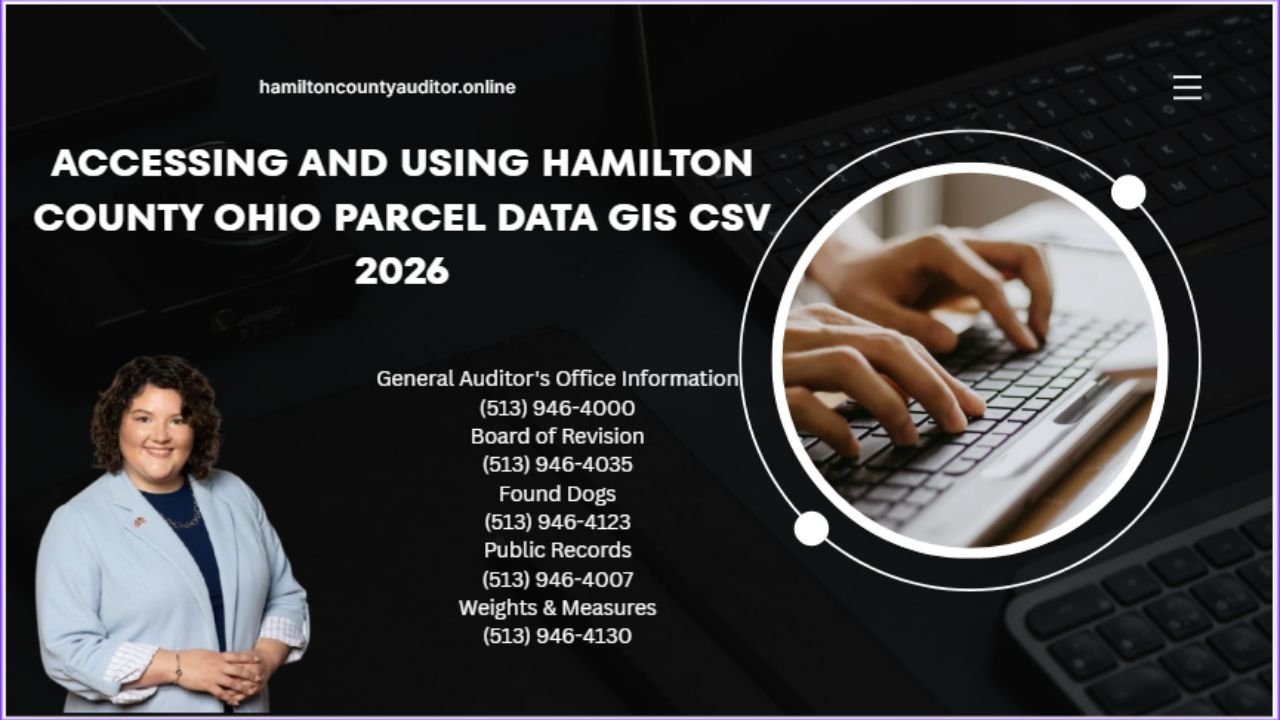

- Auditor: Jessica E. Miranda

- Address: 138 E. Court Street, Room 304, Cincinnati, OH 45202

- Office Hours: Monday – Friday, 7:30 a.m. to 4:00 p.m. (Closed on holidays)

- General Phone: (513) 946-4000

- BOR Specific Phone: (513) 946-4035

- Email: County.Auditor@Auditor.Hamilton-Co.org

- Official Website: Hamilton County Auditor

2026 Board of Revision (BOR) Filing

The Board of Revision hears complaints regarding property valuations.

Submission Method: Complaints must be filed by mail or in person; they cannot be submitted via email.

Filing Period: Complaint forms for the 2025 tax year (payable 2026) must be submitted between January 1 and March 31, 2026.

Deadline: Applications must be postmarked or filed no later than March 31, 2026.

Required Forms: Use the (Real Property Complaint Form (DTE 1) or the Manufactured Home Complaint Form (DTE 1M).

Key 2026 Deadlines & Events

2nd Half: Mailed June 17, 2026.

Triennial Appraisal: 2026 is a triennial appraisal year for Hamilton County, with updated values appearing on January 2027 tax bills.

CAUV Filing: Applications for Current Agricultural Use Value (CAUV) must be filed by March 2, 2026.

Property Tax Due Dates:

1st Half: Due February 10, 2026.

Benefits of Filing a Property Reassessment Appeal

- Potential reduction in property value

- Lower annual property tax bills

- Long-term savings if the value remains lower

- Correction of inaccurate public records

A successful appeal can positively impact property taxes for years.

Risks and Considerations

While appeals are common, they are not guaranteed.

Possible drawbacks include:

- The value may remain unchanged

- Additional documentation and preparation time

- In rare cases, the value could increase if evidence supports it

- Legal costs if pursuing higher-level appeals

Careful preparation helps reduce these risks.

Pre-Appeal Checklist

Before filing, confirm the following:

- Comparable sales support your claim

- Property details in county records are accurate

- Required forms are completed correctly

- Supporting documents are organized

- Filing deadline is met

Why Property Owners Search for the Appeal Process

Most people look up the Hamilton County reassessment appeal process for one of these reasons:

- The assessed value is higher than what similar properties recently sold for

- The tax bill increased sharply after reassessment

- Property records contain errors (square footage, condition, lot size)

- The home needs repairs or has damage not reflected in the valuation

- A recent purchase price is lower than the county’s assessed value

Appealing is a legal way to request a correction not a complaint against taxes themselves, but against the property value used to calculate them.

What Is the Hamilton County Board of Revision (BOR)

The Board of Revision (BOR) is the official body that hears property value complaints in Hamilton County. It is made up of:

- The County Auditor

- The County Treasurer

- A representative from the Board of County Commissioners

The BOR has the authority to lower, maintain, or in rare cases increase a property’s assessed value based on evidence presented.

Conclusion

The Hamilton County Ohio property reassessment appeal process exists to ensure fairness and accuracy in property taxation. When homeowners understand how reassessment works, review their notices carefully, and prepare strong evidence, they are better positioned to protect themselves from overvaluation. Filing an appeal is not about avoiding taxes it is about ensuring your property is assessed at its true market value.

For many owners, a well-prepared appeal can lead to meaningful long-term tax savings and peace of mind.

FAQs

1. What is the Hamilton County Ohio property reassessment appeal process?

The appeal process allows property owners to challenge their assessed property value if they believe it is inaccurate or unfair. Appeals are handled by the Board of Revision (BOR) following a formal filing process.

2. How do I file a property reassessment appeal in Hamilton County, Ohio?

File a complaint with the Board of Revision using DTE Form 1 (or Form 1M for manufactured homes) between January 1 and March 31. Forms can be submitted by mail or in person.

3. What evidence is required for a successful property appeal?

Owners should submit comparable sales data, independent appraisals, photos of property condition, repair estimates, and proof of incorrect county records. Strong evidence improves the chances of lowering your assessed value.

4. Can I represent myself at the Board of Revision hearing?

Yes. Property owners may appear in person without a lawyer or appraiser. Professional representation is optional for complex cases. Be prepared to present evidence clearly and factually.

5. What happens after the Board of Revision decision?

The BOR sends a written decision, typically within weeks. Approved reductions reflect in future property tax bills. If the decision is unfavorable, further appeal options include the Ohio Board of Tax Appeals or Court of Common Pleas.

6. What are the benefits and risks of filing a property reassessment appeal?

Benefits include potential property tax reduction, long-term savings, and correction of inaccurate records. Risks involve appeal rejection, additional time and effort, and rare cases where the assessed value could increase.

Post Comment