Hamilton County Ohio Property Tax Due Date 2026: A Homeowner’s Essential Guide

Managing Hamilton County ohio property tax payments in 2026 is crucial for homeowners who want to stay organized, avoid penalties, and follow the official deadline Ohio guidelines. The due date for the First Half 2026 payment is February 6, 2026, while the Second Half 2026 payment is July 15, 2026. Staying aware of these key dates ensures you remain compliant as assessments update and helps protect your financial stability throughout the tax year.

Key Deadlines: When is Your 2026 Property Tax Due

In Hamilton County, property taxes are typically billed in arrears and paid in two installments (First Half and Second Half). But You must know about how to calculate tax in our county, tax rates by districs and how to valueate tax.

| Installment | Due Date (Expected) | Period Covered |

| First Half 2026 | February 6, 2026 | First half of the tax year |

| Second Half 2026 | July 15, 2026 | Second half of the tax year |

| Check Property Tax Rates | Calculate Your Property Tax | Property Tax Valuation |

Payment Methods: How to Pay Your Tax Bill

The Hamilton County Treasurer offers several ways to settle your dues. Choosing the right one depends on your convenience:

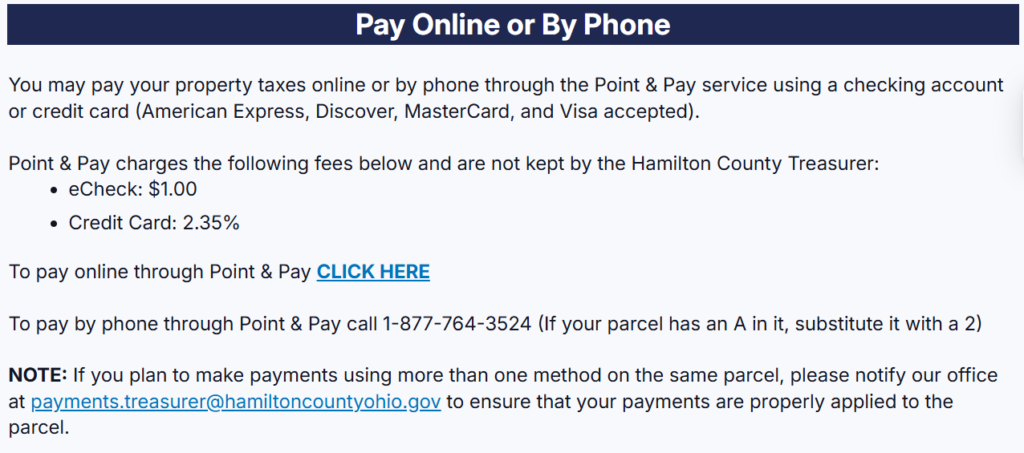

Online (E-Check or Credit Card)

Online payments are made through the Hamilton County Ohio Treasurer’s official payment portal (Point & Pay) . You can pay with an e-check from your bank account or a major credit card (Visa, MasterCard, Discover, AMEX). Schedule or submit payment anytime before the due date to avoid late penalties. Convenience fees apply: ~$1 for e-check and a percentage fee for credit cards.

By Mail

Send your check or money order to the County Treasurer’s office.

county.treasurer@hamiltoncountyohio.gov.

In-Person

Visit the County Administration Building in Downtown Cincinnati.

Hamilton County, Ohio Address138 E. Court Street, Cincinnati, OH 4520

Pro Tip

Ensure your envelope is postmarked by the due date. A “Received” date after the deadline is fine as long as the “Postmark” is on time.

Escrow via Mortgage

If you have a mortgage, your bank likely pays this for you. However, it is your responsibility to verify that the payment was made.

Hamilton County Property Tax Fees & Penalties

Missing the deadline can be expensive. If you fail to pay by the closing date, the following penalties apply under Ohio law:

- 10% Penalty: A flat 10% penalty is added to the unpaid balance immediately after the deadline.

- Interest Charges: If taxes remain unpaid for an extended period, interest starts accruing on the delinquent amount.

- Foreclosure Risk: Long-term delinquency can lead to tax lien sales or foreclosure proceedings.

Understanding Your Tax Bill (The Auditor’s Role)

While the Treasurer collects the money, the Hamilton County Auditor determines the value of your property. Your tax bill is a result of your property’s “Appraised Value” multiplied by the local tax rates (millage) approved by voters.

If you believe your 2026 property valuation is too high, you have the right to file a complaint with the Board of Revision (BOR) between January 1st and March 31st.

Contact Information

| Field | Details |

|---|---|

| Phone Number | (513) 946-4035 |

| Address | 138 E Court Street, Cincinnati, Ohio 45202 |

| Office Hours | 7:30 AM – 4:00 PM |

| Working Days | Monday – Friday |

| Contact Notes | Complaints may not be submitted via email |

How to Lower Your Taxes: Credits and Exemptions

Before you pay the full amount, check if you qualify for these reductions:

- Homestead Exemption: For seniors (65+) or disabled homeowners who meet certain income requirements.

- Owner-Occupancy Credit: A 2.5% reduction for those who live in the home as their primary residence.

- CAUV: For land used specifically for commercial agricultural purposes.

Conclusion

Staying ahead of the Hamilton County property tax deadlines for 2026 is the best way to protect your investment. Mark your calendars for February and July, keep an eye on your mail for the Auditor’s valuation updates, and always verify your payment if it’s handled through an escrow account.

Disclaimer:

This guide is for informational purposes. For official legal or financial advice, contact the Hamilton County Auditor or Treasurer’s office directly.

FAQs

When are property taxes due in Hamilton County, Ohio for 2026?

Property taxes in Hamilton County are paid in two installments. The First Half payment is typically due in early February 2026, and the Second Half payment is usually due in mid-July 2026. Check your official tax bill for the specific closing dates.

Is there a penalty for late property tax payments?

Yes. Under Ohio law, a 10% penalty is automatically added to any unpaid balance immediately after the deadline. If the payment is made within 10 days of the deadline, the penalty may be reduced to 5%, but missing the date entirely will result in interest charges.

How can I pay my Hamilton County property tax bill online?

You can pay online through the Hamilton County Treasurer’s website. Options include E-Check (usually for a small flat fee) or Credit Card (which involves a percentage-based convenience fee). You will need your Parcel ID or address to locate your record.

What is the Homestead Exemption, and who qualifies?

The Homestead Exemption allows senior citizens (65+) and permanently disabled individuals to reduce their property tax burden by shielding a portion of their home’s value from taxation. Eligibility is based on age and a specific household income threshold set by the state.

Why did my property tax bill increase this year?

Increases are usually caused by two factors: a county-wide reappraisal (conducted every six years) or the passage of new local levies (for schools, parks, or emergency services) approved by voters in your district.

Does the Hamilton County Auditor determine the tax rate?

No. The Auditor determines the “Appraised Value” of your property. The tax rate (millage) is determined by local government entities and voters. The Auditor simply applies those rates to your property’s assessed value.

Can I appeal my property valuation if I think it’s too high?

Yes. Property owners can file a formal complaint with the Hamilton County Board of Revision (BOR). The filing window is open annually from January 1st through March 31st. You must provide evidence, such as a recent appraisal or sales of comparable homes.

What should I do if my mortgage company pays my taxes?

If your taxes are held in an escrow account, your mortgage lender will receive the bill electronically and pay it on your behalf. However, it is the homeowner’s responsibility to monitor their account to ensure the payment was successfully processed before the deadline.

Can I set up a payment plan for delinquent taxes?

Yes. The Hamilton County Treasurer offers Delinquent Tax Contracts. These plans allow homeowners to pay off past-due taxes in monthly installments to prevent tax lien sales or foreclosure proceedings.

How do I change my mailing address for my tax bill?

You must notify the Hamilton County Auditor’s Office in writing or through their online portal to update your billing address. This ensures you receive your semi-annual tax statements on time and avoid missed deadlines.

Post Comment